Bond rate of return formula

Internal rate of return is. This rate applies for the first six months you own the bond.

Yield To Maturity Approximate Formula With Calculator

For example consider the purchase of a bond at par value for 1000 with a 3 coupon rate.

. In our example that would be one plus 7 percent or 107. Therefore Adam realized a 35 return on his shares over the two-year period. T Period of calculation.

Original value 2000. New Look At Your Financial Strategy. Internal Rate of Return - IRR.

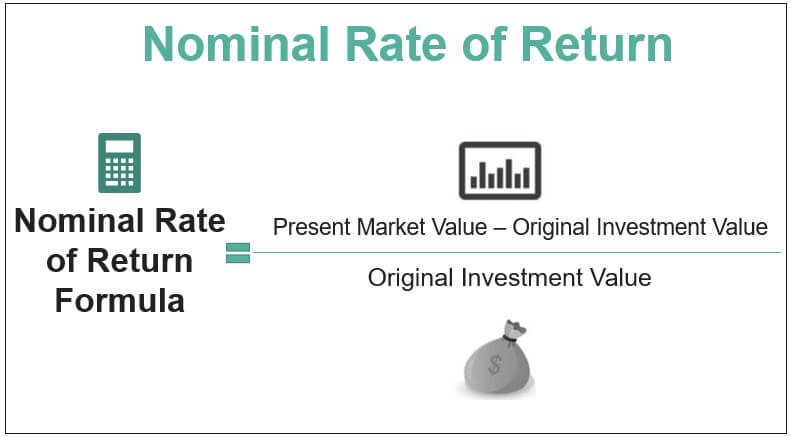

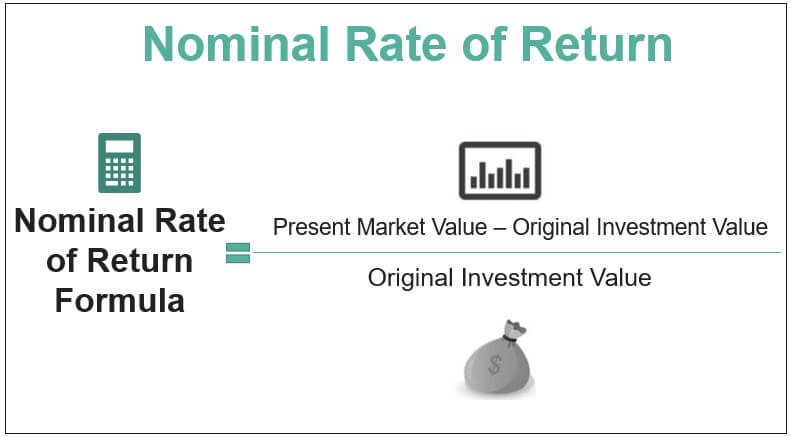

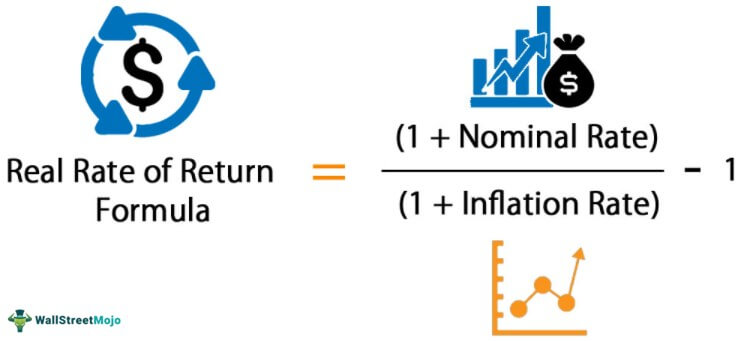

Determine your nominal rate of return and add one to the percentage. Given Current value 3500. Plug all the numbers into the rate of return formula.

The composite rate for I bonds issued from May 2022 through October 2022 is 962 percent. Therefore the investor earned an annual return at the rate of 160 over the five-year holding period. Suppose you buy a 1000 par value bond with a 65 coupon at a discount for 800.

Firstly determine the risk-free rate of return which is the return of any. Rate of Return Formula. New Look At Your Financial Strategy.

How do I bonds earn. Yield to maturity YTM is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. The formula is based on the principle that despite the constant coupon rate until maturity the expected.

You can find this data. Determine the inflation rate for the year. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The formula for Bond Yield can be calculated by using the following steps. Internal Rate of Return IRR is a metric used in capital budgeting to estimate the profitability of potential investments. Visit The Official Edward Jones Site.

250 20 200 200 x 100 35. A PX 1 Rn nT where. The required rate of return for a stock not paying any dividend can be calculated by using the following steps.

Using the rate of return formula calculate the rate of return. Let us take the example of Dan who invested. The interest paid on this bond would be 30 per year.

A Amount or Return after a particular period of calculation. The formula for rate of return is as follows. Ad Use Our Simple Tools To Create Your Bond Strategy.

Rate of return Current value of investment Initial value of investment Initial investment value 100. R Rate of Interest. The current yield is equal to the 65 coupon divided.

The rate of return formula is used in investment real estate. The actual rate of return you get is called current yield. Mathematically it is the discount rate at.

Visit The Official Edward Jones Site. Annual Return Formula Example 2. N Interest payment frequency.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Yield To Maturity Ytm Formula And Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

Nominal Rate Of Return Definition Formula Examples Calculations

Current Yield Formula Calculator Examples With Excel Template

Bond Yield Calculator

Coupon Rate Formula Calculator Excel Template

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

What Is Coupon Rate In Bonds Know More Fincash Com

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Formula And Calculator Excel Template

Real Rate Of Return Definition Formula How To Calculate

Yield To Maturity Fixed Income

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

How Can I Calculate A Bond S Coupon Rate In Excel

Bond Yield Calculator

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Zero Coupon Bond Yield Formula With Calculator